Smart Ways to Prepare for Next Year’s Taxes

Smart Ways to Prepare for Next Year’s Taxes

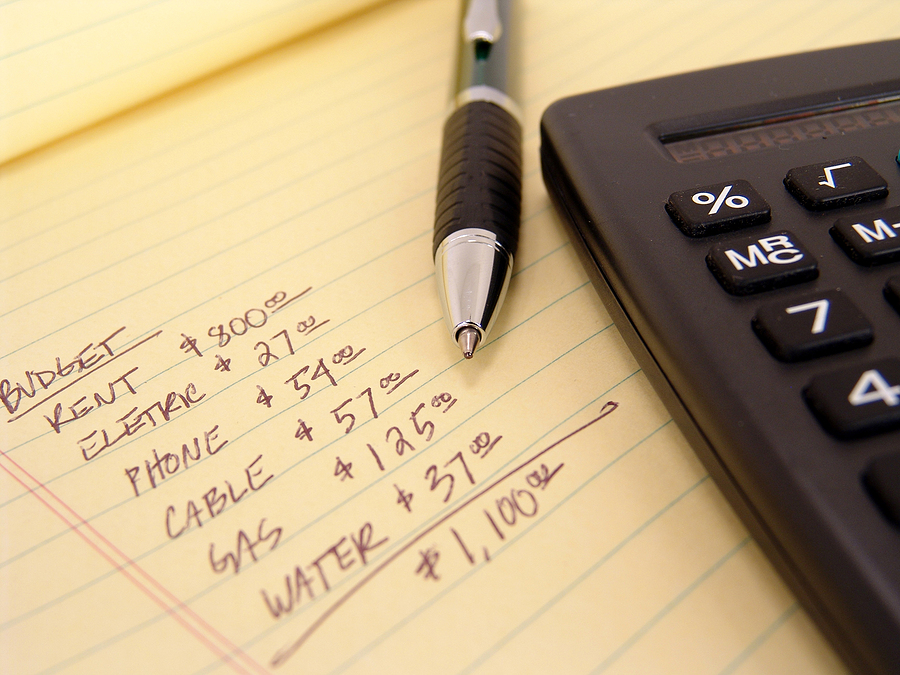

The financial decisions you make between now and the end of the year can significantly impact how much taxes you will have to pay once tax day arrives. There are things you can do now to help prepare for next year’s taxes.

If you take action by December 31st, you may reduce your tax burden and keep more of your hard-earned money. Here are some smart strategies to get ahead of your year-end tax planning:

1. Max out your retirement savings contributions

Tax-advantaged retirement accounts like 401(K)s and IRAs fund with pre-tax dollars. Any contributions you make can lower your taxable income. Therefore, max out your retirement account contributions if you can do so. If you receive a bonus from your employer at the end of the year and still need to max out your contributions, request to contribute it to your pre-tax retirement savings account.

In addition, use the IRS contribution limit notice for 2023 or contact your financial professional to determine how much you can save to help lower your taxes based on your situation.

2. Maximize your flexible saving account (FSA) contributions

FSAs are pre-tax healthcare savings accounts offered through employers designed to cover out-of-pocket healthcare costs. You don’t pay taxes on the money you contribute to an FSA. Here are a few more things about FSAs:

- Employers may contribute to your FSA, but they aren’t required to.

- You submit a claim to the FSA (through your employer) with proof of the medical expense and a statement that your plan hasn’t covered it.

- In addition, you’ll get reimbursed for your healthcare costs.

3. Participate in charitable giving

The third way to prepare for next year’s taxes is charitable giving enables you to support a cause or organization you believe in. Still, it also offers a great way to save on taxes, even if you take the standard deduction. You can donate appreciated property or stock instead of cash to enhance your tax benefits further. No matter how you donate, keep a receipt, credit card or bank statement. One of these or any other document that proves your contribution.

You can also give using a donor-advised fund or a strategy such as a trust. It would be best to talk to your legal, tax, and financial professional to help you determine an appropriate giving strategy.

4. Contribute to a 529 Plan

If you have children or grandchildren and would like to help them with the cost of college. There’s no better time than now to fund their 529 plans. You may deduct state taxes for contributions to a state-sponsored program, but consult your tax professional to understand the rules to take a tax deduction.

There is no federal tax deduction for contributions to a 529 plan, but the money in these accounts grows tax-free and can be withdrawn to use toward qualified education expenses like tuition, room and board, books, and supplies associated with the education.

In conclusion, your financial and tax professionals can help you determine which strategies are appropriate for your situation as you prepare for next year’s taxes.

Disclosures

This article is designed to provide general information on the subjects covered. Pursuant to IRS Circular 230, it is not intended to provide specific legal or tax advice and cannot be used to avoid penalties or to promote, market, or recommend any tax plan or arrangement. You are encouraged to consult your personal tax advisor or attorney. Guarantees are backed by the financial strength and claims-paying ability of the issuing company. Pursuant to IRS Circular 230, it is not intended to provide specific legal or tax advice and cannot be used to avoid penalties or to promote, market, or recommend any tax plan or arrangement. You are encouraged to consult your personal tax advisor or attorney.

SWG 2909136-0523e

In addition, The Legacy Source specializes in providing strategies and guidance for those who are seeking a better lifestyle in retirement. If you have retirement savings of five million dollars or $50,000, we can ensure it works as hard. As a result, we offer our experience and knowledge to help you design a custom strategy for financial independence. Contact us today to schedule an introductory meeting!