Simplicity Digital Advisor

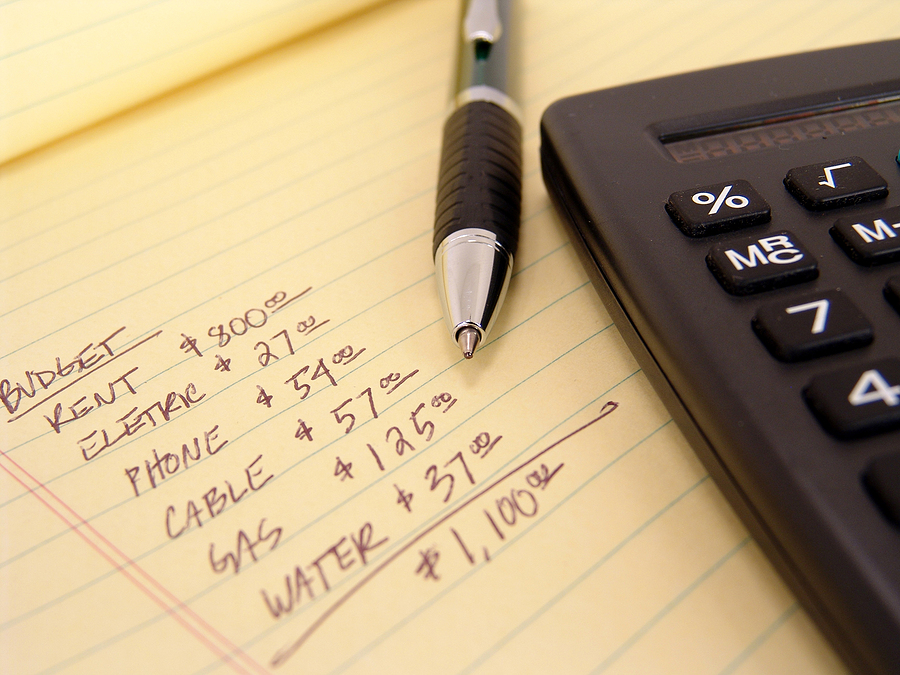

The Real Costs of Buying a Home

When you’re ready to buy a house, it’s essential to consider the upfront costs and ongoing expenses outside of taxes, utilities, and home maintenance.

5 Retirement Savings options- Which is Suitable for You?

Suppose you already know your retirement savings options; congratulations! You’re on your way to a more financially secure retirement. You must continue to save and determine other retirement savings vehicle strategies that may be appropriate for your situation.

Charitable Giving in Your Financial Plan

As you grow your wealth, you may find the desire to give back. That’s where charitable giving comes in. Charitable giving can allow you to support causes and organizations you believe in while reducing your income tax, capital gains, and estate taxes. Here are several ways to incorporate charitable giving into your overall financial plan:

College Planning as Part of Your Financial Plan

While there’s no obligation to pay for your child’s or grandchild’s college education. Helping them fund some or all of it can allow them to avoid overwhelming amounts of student loan debt. It can also help them to begin adulthood on the right foot.

Here are some tips if you’re interested in incorporating college planning into your financial plan:

Budgeting for Travel in Retirement

If you love to travel and immerse yourself in new cultures and experiences, there’s a good chance you’re looking forward to traveling in retirement.

The Do’s and Don’ts of Reducing Debt

According to one study, the average American has $90,460 in debt, which includes all types of consumer debt, such as credit cards, personal loans, and car loans.

The Impact of Inflation on a 401(k)

In simple terms, inflation is the rate at which the cost of goods and services rises. Due to inflation, it costs more money to buy groceries, gas, or anything else than it did in the past. Inflation can also affect your retirement savings as stocks, and other investments don’t automatically adjust for it. Rising inflation means your investments will have to work harder to keep pace. The extent to which inflation will impact your 401(k) will depend on several factors, like your investing strategy and how close you are to retirement.

5 Ways to Keep Emotions Under Control During a Volatile Market

The stock market can be volatile and will always go up and down. If your emotions run high during a volatile market, you’re not alone. The good news is you can take steps to help keep your feelings of fear and anxiety in check and avoid poor investment decisions based on emotions. Here’s a closer look at five ways to keep your emotions under control during periods of stock market volatility:

The Importance of a Diversified Portfolio In a Bear Market

The old saying, “Don’t put all your eggs in one basket,” applies to many areas of life, including investing. If you put all your money into a single investment, you may take on more risk than you would if you had a diversified portfolio.

Should You Rebalance Your Portfolio?

Is it time to rebalance your portfolio? Your portfolio should align with your risk tolerance, retirement timeline, and long-term goals. These factors may help you decide on the appropriate asset allocation for your unique situation.